Reksa Dana

Based on Financial Services Authority Regulation (POJK) Number 3/POJK.04/2021, relating to the implementation of activities in the capital market sector, mutual funds are a forum used to collect funds from the investing public to then be invested in securities portfolios by investment managers.

Meanwhile, according to the Financial Services Authority (OJK), APERD, or Mutual Fund Selling Agent, is the party selling the mutual fund based on a cooperation agreement with the investment manager managing the mutual fund.

KB Valbury Sekuritas has been legally and officially registered as a Mutual Fund Selling Agent (APERD) with license number S-2290/PM.02/2023.

Requirements and Procedures for Mutual Funds Subscription at KB Valbury Sekuritas

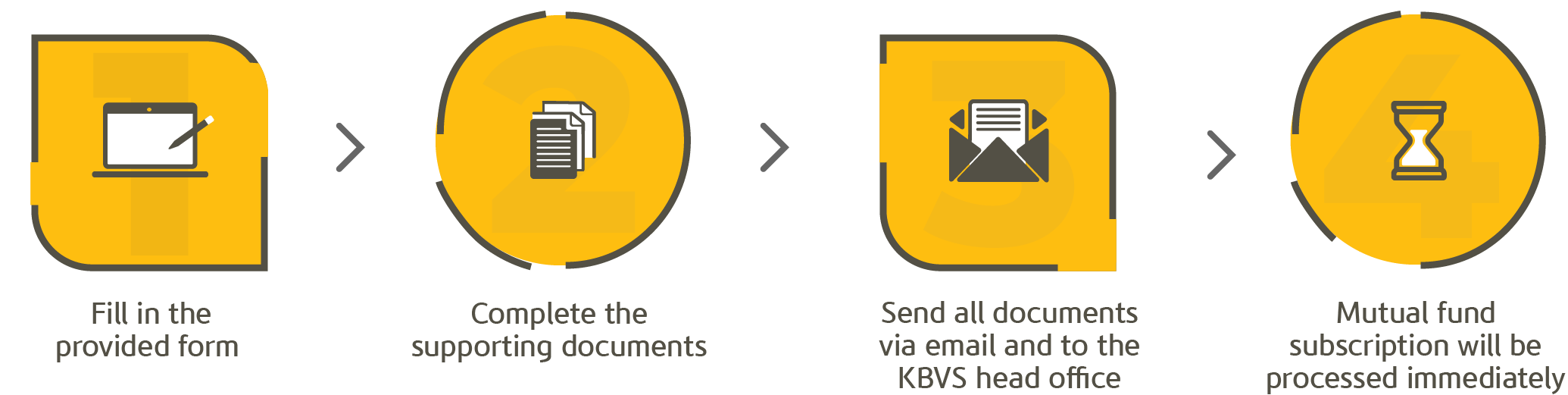

Mutual Fund Subscription Process:

Requirement for mutual fund subscription:

Investor is a customer of KB Valbury Sekuritas. If you are not yet a KB Valbury Sekuritas customer, please open an account by clicking here

Investors must complete the following additional documents:

a. Risk Profile Form

b. KTP, and NPWP (for customers who are purchasing mutual funds for the first time at KB Valbury Sekuritas)

c. Subscription/Redemption Form

Please send a soft copy of the signed document to [email protected], while the printed document must be sent to KB Valbury Sekuritas Head Office (Sahid Sudirman Centre, Jl. Jenderal Sudirman, Lt. 41, Central Jakarta).

Mutual fund subscription or redemption forms received by KB Valbury Sekuritas no later than 13.00 WIB will be processed based on today's NAV (net asset value), while forms received after the deadline will be processed on the next exchange day.

If you have further questions, please contact our Helpdesk at (021) - 250 98300 or email [email protected]

Mutual Fund Product List

No | Product Name | Transaction Fee | Minimum Transaction | Fund Manager | Product Category | Risk Level | Custodian Bank | Document |

|---|---|---|---|---|---|---|---|---|

| 1 | Valbury Money Market | - | IDR 100,000 | PT KB Valbury Asset Management | Money Market | Low | PT Bank Central Asia, Tbk | FFS Prospektus |

| 2 | Valbury Investasi Berimbang | - | IDR 100,000 | PT KB Valbury Asset Management | Balanced | Medium | PT Bank Central Asia, Tbk | FFS Prospektus |

| 3 | Valbury STAR Fund | - | IDR 1,000,000 | PT KB Valbury Asset Management | Fixed Income | Medium | Bank Pembangunan Daerah Jawa Barat dan Banten, Tbk | FFS Prospektus |

| 4 | Valbury PRIDE | - | IDR 100,000 | PT KB Valbury Asset Management | Equity | High | PT Bank Negara Indonesia (Persero) Tbk | FFS Prospektus |

| 5 | Capital Money Market Fund | - | IDR 50,000 | PT Capital Asset Management | Money Market | Low | PT Bank Danamon Indonesia, Tbk | FFS Prospektus |

| 6 | Capital Fixed Income Fund | - | IDR 50,000 | PT Capital Asset Management | Fixed Income | Medium | PT Bank Danamon Indonesia, Tbk | FFS Prospektus |

| 7 | Capital Sharia Money Market | - | IDR 50,000 | PT Capital Asset Management | Money Market | Low | PT Bank Danamon Indonesia, Tbk | FFS Prospektus |

| 8 | Capital Sharia Fixed Income | - | IDR 100,000 | PT Capital Asset Management | Fixed Income | Medium | PT Bank Danamon Indonesia, Tbk | FFS Prospektus |

| 9 | Capital Optimal Cash | - | IDR 50,000 | PT Capital Asset Management | Money Market | Low | PT Bank KEB Hana Indonesia | FFS Prospektus |

| 10 | Capital Optimal Equity | - | IDR 50,000 | PT Capital Asset Management | Equity | High | PT Bank DBS Indonesia | FFS Prospektus |

| 11 | Capital Balanced Growth | - | IDR 50,000 | PT Capital Asset Management | Balanced | Medium | PT Bank DBS Indonesia | FFS Prospektus |

| 12 | BMI Indo Obligasi Mantap | - | IDR 100,000 | PT Berdikari Manajemen Investasi | Fixed Income | Medium | PT Bank KEB Hana Indonesia | FFS Prospektus |

| 13 | BMI Indo Pasar Uang | - | IDR 100,000 | PT Berdikari Manajemen Investasi | Money Market | Low | PT Bank Mega Tbk | FFS Prospektus |

| 14 | BMI Indo Saham Andalan | - | IDR 100,000 | PT Berdikari Manajemen Investasi | Equity | High | PT Bank Mega Tbk | FFS Prospektus |

| 15 | MNC Dana Likuid | - | IDR 250,000 | PT MNC Asset Management | Fixed Income | Medium | PT Bank Negara Indonesia (Persero) Tbk | FFS Prospektus |

| 16 | MNC Dana Syariah | - | IDR 250,000 | PT MNC Asset Management | Fixed Income | Medium | PT Bank Negara Indonesia (Persero) Tbk | FFS Prospektus |

| 17 | MNC Dana Syariah Barokah | - | IDR 250,000 | PT MNC Asset Management | Money Market | Low | PT Bank Negara Indonesia (Persero) Tbk | FFS Prospektus |

| 18 | MNC Dana Lancar | - | IDR 250,000 | PT MNC Asset Management | Money Market | Low | PT Bank Central Asia, Tbk | FFS Prospektus |

| 19 | Phillip Goverment Bond | - | IDR 100,000 | PT Phillip Asset Management | Fixed Income | Medium | PT Bank DBS Indonesia | FFS Prospektus |

| 20 | Phillip Money Market Fund | - | IDR 100,000 | PT Phillip Asset Management | Money Market | Low | PT Bank Permata, Tbk | FFS Prospektus |

| 21 | Phillip Money Market Fund Syariah Bermanfaat | - | IDR 100,000 | PT Phillip Asset Management | Money Market | Low | PT Bank Permata, Tbk | FFS Prospektus |

| 22 | KIM Fixed Income Fund Plus | - | IDR 100,000 | PT Korea Investment Management Indonesia | Fixed Income | Medium | PT Bank KEB Hana Indonesia | FFS Prospektus |

| 23 | KIM Money Market Fund | - | IDR 100,000 | PT Korea Investment Management Indonesia | Money Market | Low | PT Bank KEB Hana Indonesia | FFS Prospektus |

| 24 | Maybank Obligasi Syariah Negara | - | IDR 100,000 | PT Maybank Asset Management | Fixed Income | Medium | PT Bank Syariah Indonesia Tbk | FFS Prospektus |

| 25 | MAM Balanced Fund | - | IDR 100,000 | PT Maybank Asset Management | Balanced | Medium | PT Bank Negara Indonesia (Persero) Tbk | FFS Prospektus |

Download the Mutual Fund Subscription/Redemption Form:

PT KB Valbury Sekuritas acts as a Mutual Fund Selling Agent (APERD), which is licensed and supervised by the Financial Services Authority (Otoritas Jasa Keuangan – OJK).

All investments involve risk and a possible loss of investment value. Past performance does not reflect future performance. Historical performance, expected returns, and probability projections are provided for informational and illustrative purposes. Mutual funds are capital market products and not APERD products. APERD is not responsible for the risks of portfolio management carried out by the investment manager.