IPO Obligasi PT Indah Kiat Pulp & Paper Tbk

About the Company:

PT Indah Kiat Tbk is a company engaged in the production of pulp, cultural paper, industrial paper, and tissue. The company’s business activities range from processing wood into pulp and paper to recycling wastepaper into industrial paper. Pulp serves as the raw material for cultural paper, tissue, and industrial paper. Currently, the company operates production facilities in Perawang (Riau Province), Serang, and Tangerang (Banten Province), with a total annual production capacity in 2019 of 3.0 million tons of pulp, 1.7 million tons of cultural paper, 108 thousand tons of tissue, and 2.1 million tons of packaging. In 2019, the company exported approximately 52% of its products, mainly to countries in Asia, Europe, the United States, the Middle East, Africa, and Australia, while the remaining 48% was distributed to meet domestic market demand.

Product Information:

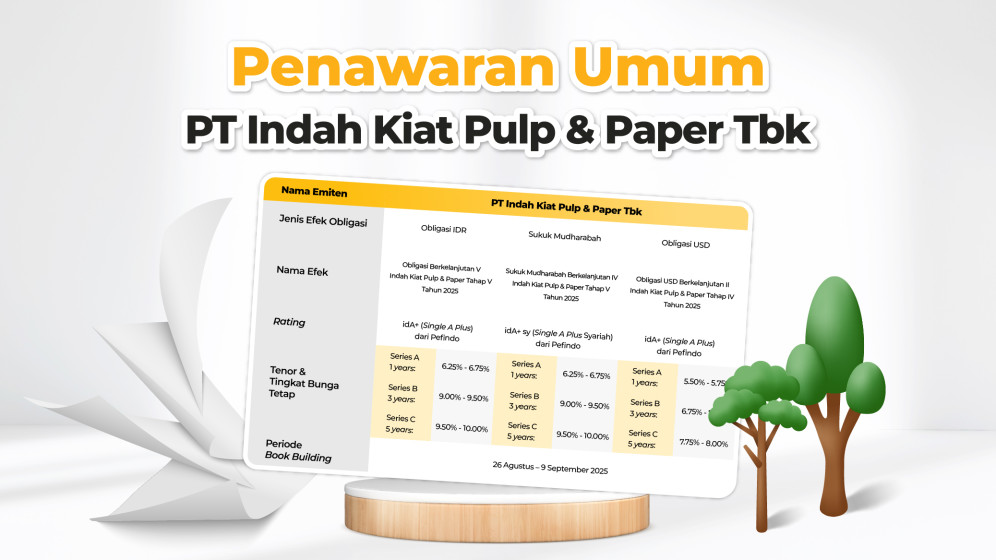

Issuer Name | PT Indah Kiat Pulp & Paper Tbk | |||||

| Jenis Efek Obligasi | Obligasi IDR | Sukuk Mudharabah | Obligasi USD | |||

| Bond Name | Obligasi Berkelanjutan V Indah Kiat Pulp & Paper Tahap V Tahun 2025 | Sukuk Mudharabah Berkelanjutan IV Indah Kiat Pulp & Paper Tahap V Tahun 2025 | Obligasi USD Berkelanjutan II Indah Kiat Pulp & Paper Tahap IV Tahun 2025 | |||

| Rating | idA+ (Single A Plus) from Pefindo | idA+ sy (Single A Plus Syariah) from Pefindo | idA+ (Single A Plus) from Pefindo | |||

| Tenor and Interest Rate | Series A – 1 years: | 6.25% - 6.75% | Series A – 1 years: | 6.25% - 6.75% | Series A – 1 years: | 5.50% - 5.75% |

Series B – 3 years: | 9.00% - 9.50% | Series B – 3 years: | 9.00% - 9.50% | Series B – 3 years: | 6.75% - 7.00% | |

Series C – 5 years: | 9.50% - 10.00% | Series C – 5 years: | 9.50% - 10.00% | Series C – 5 years: | 7.75% - 8.00% | |

| Book Building Periode | 26 August – 9 September 2025 | |||||